Gold vs Silver Price in Nepal

Gold vs Silver Price in Nepal compares the daily rates and market trends of gold and silver. Understanding the price difference and historical patterns helps buyers and investors make informed decisions for purchases and investments. Check today's gold and silver prices or explore the historical data for more insights.

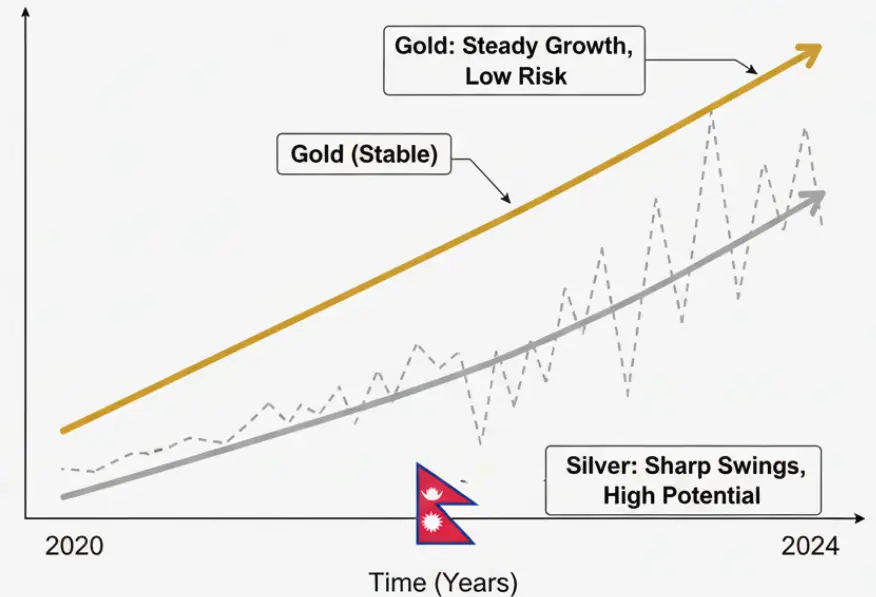

Historical Performance Comparison

Over the last few decades, both gold and silver have played significant roles in Nepalese households and investment strategies. Gold has historically maintained its value across generations, acting as a hedge against inflation and a safe store of wealth. In Nepal, gold prices have shown relatively steady annual growth, often rising between 8% to 12% per year. This stability has made gold the preferred choice for long-term wealth preservation, wedding gifts, and family heirlooms. Families tend to purchase gold not only for investment but also for cultural and ceremonial purposes, such as Daijo, Teej, Dashain, and Tihar. View gold price history.

Silver, by contrast, has experienced greater fluctuations in its market value. Historically, silver has shown a more volatile pattern in Nepal, responding sharply to global industrial demand, geopolitical events, and currency movements. While silver’s price movements are more pronounced, it also provides opportunities for short-term gains. Over the past two decades, silver has occasionally outperformed gold during bullish global markets. View silver price history.

Historically, the Nepalese market has followed international trends, with additional premiums due to import duties (around 13% customs duty) and local demand spikes during festival seasons. While gold continues to attract high-net-worth individuals, silver’s affordability allows middle-class households to participate in precious metal investment, creating a dual-tier investment culture in Nepal.

Volatility Comparison

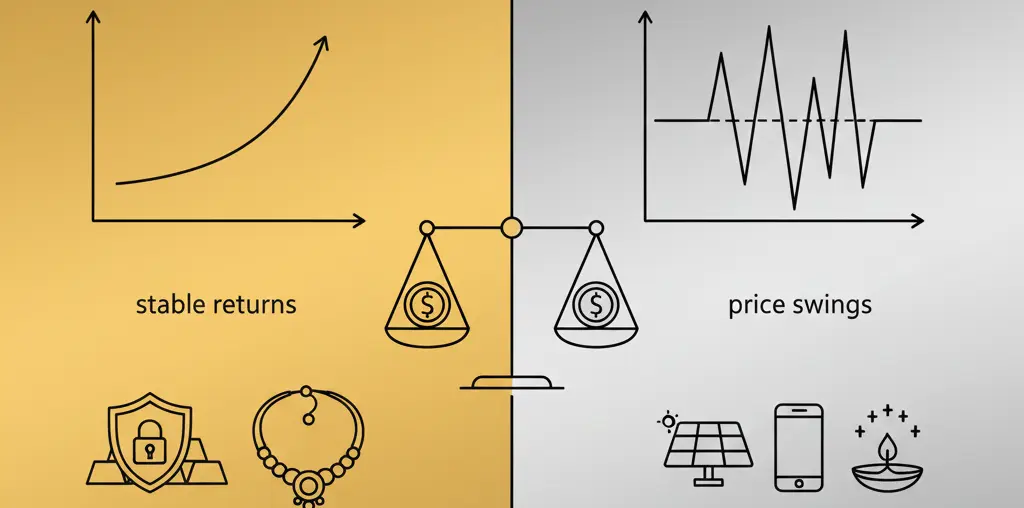

When comparing volatility, gold in Nepal demonstrates low risk relative to silver. Prices tend to remain stable, providing predictable returns that make it ideal for long-term planning. Gold’s low volatility is attributed to its global demand, limited supply, and its role as a traditional safe-haven asset. In the Nepalese context, gold retains social and financial significance, further stabilizing its price as buyers purchase it regardless of minor market fluctuations. View gold price chart.

Silver, on the other hand, is subject to more frequent price swings. Its volatility is influenced by both international industrial demand and local market conditions. For instance, increased solar panel imports, electronic industry expansion, or festival demand can lead to rapid price spikes. Conversely, lower seasonal demand or currency fluctuations can trigger sharp declines. This makes silver riskier for short-term investors but potentially more rewarding if timed correctly. Many Nepalese investors adopt a strategic approach, buying silver during post-festival corrections and selling during high-demand periods. View silver price chart.

Understanding these dynamics is crucial. Households with limited funds may prefer silver for its lower entry cost, while those seeking security and wealth preservation rely primarily on gold. Combining both metals in a single portfolio helps balance risk and potential returns.

Investment Risk Comparison

Gold offers relatively low investment risk in Nepal. Its value is less likely to be affected by short-term economic turbulence, political instability, or currency fluctuations. Gold remains highly liquid, allowing investors to quickly convert holdings into cash if needed. Additionally, hallmarked gold ensures authenticity, further reducing investment risk.

Silver, however, carries higher investment risk due to its price volatility. While it can provide higher short-term returns, it is also susceptible to sharp declines. Industrial demand, currency fluctuations, and sudden spikes in global market activity can impact silver prices more dramatically than gold. Investors must carefully monitor market conditions, timing their purchases and sales to mitigate losses. Many Nepalese investors adopt a balanced approach, allocating a higher percentage to gold and a smaller proportion to silver for potential growth.

Risk can also be managed by considering storage and liquidity. Gold is typically stored in bank lockers, ensuring security and peace of mind. Silver, being more affordable, can be safely stored at home. Understanding these risk factors helps Nepalese households make informed decisions on metal allocation and investment timing. Use our price calculator to estimate investments.

Nepal Context: Cultural & Financial Relevance

Nepalese households view gold and silver as both cultural symbols and financial instruments. Gold is integral to festivals like Dashain and Tihar, where families invest heavily to honor traditions and secure blessings. Weddings remain one of the most significant reasons for gold accumulation, with families purchasing 5–10 tolas of gold for brides. Even during non-festival seasons, gold is considered a long-term investment for future generations. Check today's gold prices.

Silver, in contrast, is more embedded in daily and practical uses. Silver coins, utensils, anklets, and puja items are common in rural and urban households. Due to its affordability, silver serves as a tool for gradual wealth accumulation, particularly for middle-class families. Silver also has potential growth prospects due to its industrial use in solar panels, electronics, and medical equipment. Nepalese investors often monitor these sectors to capitalize on silver price trends. Check today's silver prices.

Liquidity in Nepal is another key factor. Gold can be sold quickly through banks and licensed jewelers, especially in Kathmandu, Pokhara, and other major cities. Silver, while liquid, may require more effort to ensure fair pricing in local markets. The balance between cultural significance, investment potential, and liquidity drives Nepalese households’ decisions on gold and silver allocation.

Jewelry vs Investment Usage

Gold primarily serves dual purposes in Nepal: jewelry and investment. Jewelry purchases, including necklaces, bangles, earrings, and rings, are culturally significant, particularly during weddings, festivals, and family rituals. Investment in gold bars or coins is used to hedge against inflation, build retirement funds, and secure generational wealth. Gold's resale value is high, making it both a decorative and financial asset. Check current gold prices.

Silver, while also used for jewelry, is more common in daily utensils, religious artifacts, coins, and small gifts. Industrial applications, including solar panels and electronics, provide additional investment rationale. Because silver is affordable, households can purchase it regularly, building wealth gradually. Both metals are hallmarked to ensure purity, providing confidence to buyers and investors. Check current silver prices.

Conclusion: Gold vs Silver

When Gold is Better

- Long-term security and wealth preservation

- Cultural significance for weddings & festivals

- Inheritance planning

- Hedging against economic uncertainty

- Stable returns and high liquidity

- Widely recognized and easy to resell globally

- Preferred by high-net-worth households

When Silver is Better

- Limited budget with gradual wealth building

- Higher short-term gain potential

- Portfolio diversification

- Industrial investment interest

- Daily rituals and emergency savings

- Affordable entry point for new investors

- Accessible in small quantities for middle-class families